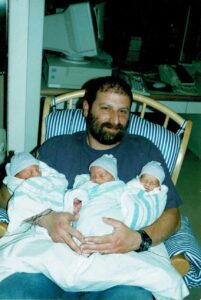

Here’s what: just as the Giants have recognized the need to raise some cash and are selling 10% of the Giants to private equity, I too would like to raise some cash and want to sell 10% of the triplets to private equity (the 10% would be divided equally among the 3). Here are 5 reasons I think this is a way better opportunity for private equity than investing in the Giants.

- Giants are raising capital to improve and upgrade a single ballpark. I am offering a percent in triplets. That’s 3X better than the Giants!

- Giants are arguing that they need money to address aging infrastructure. I am offering the opportunity to invest in kids entering the prime of their lives.

- Giants are asking for funds for a ballpark that (sorry Giants) may never have the same earning potential it did 20 or 25 years ago (anyone remember 3 World Series, Barry Bonds, the All-Star Game?); the triplets haven’t hit their prime earning potential (at least I hope not).

- The Giants rely on ticket sales, TV contracts, and merchandise, all tied to a single sports franchise. The triplets? They have limitless potential across multiple

- The Giants’ success depends on unpredictable factors like player performance, injuries, and team management. With the triplets, you’re betting on three independent individuals, each with unique talents and career paths. Even if one underperforms, the others could hit it big—built-in risk mitigation for those risk mitigating equity folks.

There you go – 5 solid reasons private equity should want to buy 10% of the triplets born the same day as PacBell! I take cash, cashier’s checks, credit cards (though I will have to charge you 3% more thanks to that crazy VISA/Mastercard duopoly) but no cryptocurrency. I used to be willing to take Dogecoin but suspect you can understand why anything DOGE is now off limits.

GO GIANTS!

For almost 30 years Pet Camp has been providing San Francisco’s dogs and cats with award winning pet care. If you are a pet parent in the San Francisco Bay Area with a dog or a cat and in need of overnight care, dog day care, dog training, bathing/grooming or pet transportation give us a call and chat with one of our counselors.